Walmart’s role in the aftermath of hurricane Katrina is the stuff of legends. So much so that even Harvard’s Kennedy School of Government teaches it. (see here)

Forced to close 126 stores in the region, Walmart, from its “emergency operations center” equipped with the latest weather forecast systems, upgraded Katrina from a tropical storm to a hurricane by August 24th. In the 2 1/2 weeks before and during the hurricane, Walmart delivered 2,500 containers to the region, donated $18mn in cash for emergency needs, and gave enough food for 100,000 free meals.

By contrast, the mayor of New Orleans delayed the evacuation order until one day before landfall (on August 28th), the same day the National Weather Service finally issued a bulletin warning against “devastating damages”. Mobilised troops did not reach 10,000 until August 30th, after Katrina hit the region three times.

Famously FEMA, the Federal Emergency Management Agency, had sent hundreds of volunteer firefighters to Atlanta for two days of training classes on topics including sexual harassment and the history of FEMA…

Boston academics may see it as a cautionary tale about coordination between government and local authorities, but it’s hard not to be struck by the contrast between the readiness of companies and the ineptitude of authorities. Delivering 142,000 items on average to 4,600 stores (Walmart’s US footprint) apparently teaches you a thing or two about logistics... But so should FEMA’s $33Bn annual budget.

Either way: a few days of preparation and the right equipment can save hundreds of lives, and accelerate the reconstruction of affected regions.

It looks like we are going to need it.

There's something going on with Natural Disasters

After steadily compounding 48% over its first year of existence (starting Dec 5th with 10 names), ignoring the broader market, our “Extreme Weather Events” basket started to track the market and the vagaries of trade wars.

In other words: a long term, secular growth story started to trade on short term drivers.

For instance the chart below shows the performance of our 10-stock thematic basket (our Top 5 and Top 20 baskets did the same):

And those Top 10 stocks also tracked the companies’ earnings revision, which were small. This is the contribution of earnings revision to total returns:

And yet….

The trend continues its upward march (with a seasonality) in its recognition by management, retail traders and the press:

So, what happened?

We believe that this theme went into “hibernation” during the winter.

But while the market was looking elsewhere (trade wars, AI…), the managements in charge of running these businesses were getting more and more preoccupied by it. In fact, smoothing out the seasonality in word counts and sentiment - They have never been more worried about Extreme Weather Events as today.

We believe that they know a lot more about their environments than we do - and we think that the theme is about to wake up.

Extreme Weather Events are getting more frequent

Setting aside the debate over their causes (human or natural), if we take a clean, numerical definition of the five main extreme weather events (Floods, Storms, Heatwaves, Droughts and Wildfires), the rise in their intensity and frequency is undeniable:

The UN reported 7,348 major disasters in 2000–2019 vs. 4,212 in 1980–1999 (nearly +75%).

Much of this rise is due to more frequent climate-related hazards (extreme weather events). For example, the number of major floods more than doubled (from 1,389 to 3,254) and storms increased by ~40% (1,457 to 2,034).

The US has seen a particularly steep increase in events causing ≥$1Bn in damages. Data from NOAA (the US National Oceanic and Atmospheric Administration) shows that from 1980–2024 the US averaged about 9 such events per year, but in the last five years (2019–2023) the average spiked to 24 events per year. 2023 set a new record with 28 separate billion-dollar weather/climate disasters in the US.

~90% of disasters between 2000 and 2019 were climate or weather-related. In 2024, for example, weather catastrophes accounted for 93% of all disaster events globally. Floods and storms were the most common (44% and 28% of total).

Economic losses are rising even faster

Re-insurers like Munich Re are giving us the best information here. It is crucial for them to get the trend right. Here is what Munich Re sees as the last 45 year trend:

Rising Averages: According to Munich Re, the inflation-adjusted 30-year average (1990s–2010s) for global disaster losses is about $181Bn per year, whereas the most recent 10-year average (2014–2023) is around $236Bn per year. Insured losses show a similar jump – from an average of ~$61Bn (30-year) to ~$94Bn (10-year) annually. Disaster costs have increased a lot over the last two decades.

Record Loss Years: The period 2004–2024 has seen multiple record-breaking disaster years.

Globally, 5 of the costliest disaster years on record (since 1980) occurred in the past 20 years. 2024 incurred $320Bn in total losses (the 5th highest on record) and $140Bn in insured losses (the 3rd highest ever).

These 2024 losses were far above the 10-year average (by ~35% for total losses, and ~50% for insured).

But even moderate recent years now routinely see ~$200–300Bn in economic losses (e.g. 2022 had ~$270Bn, 2023 had ~$268Bn), whereas no single year in the 1980s exceeded $100Bn in today’s dollars.

Insured vs. Uninsured (Protection Gap): insured losses have grown particularly fast, reflecting both greater insurance penetration and costlier events. This matters a lot to a number of companies in our Investible Universe, as their clients use insurance proceeds to buy their products and services.

From 2017 through 2023, insured catastrophe losses worldwide exceeded $100Bn each year – a stretch of high payouts never seen before. In 2024 they hit $140Bn.

This continues a long-term ~5–7% annual growth in insured losses (after inflation) that Swiss Re identified during the 1990s. It can still grow: a large protection gap remains – roughly half or more of disaster losses are still uninsured globally. In 2024, about 57% of losses were uninsured.

Rich regions like North America have higher insurance coverage (global insurance covered ~34% of losses since 1980, but ~50% in recent years), whereas in developing countries insurance often covers <10% of losses. Many losses in poorer regions go uncompensated, even as total damages rise.

Being prepared: a very high return strategy

It would be wrong to assume that a Natural Disaster destroys a region, but after a few years of reconstruction, life goes back to normal.

Quite the reverse: they slowly change how much people work, their productivity, how they invest, and a lot of other crucial macroeconomic drivers. They may be “hidden” by shorter economic cycles and external shocks, but they’re having a durable effect on the economy.

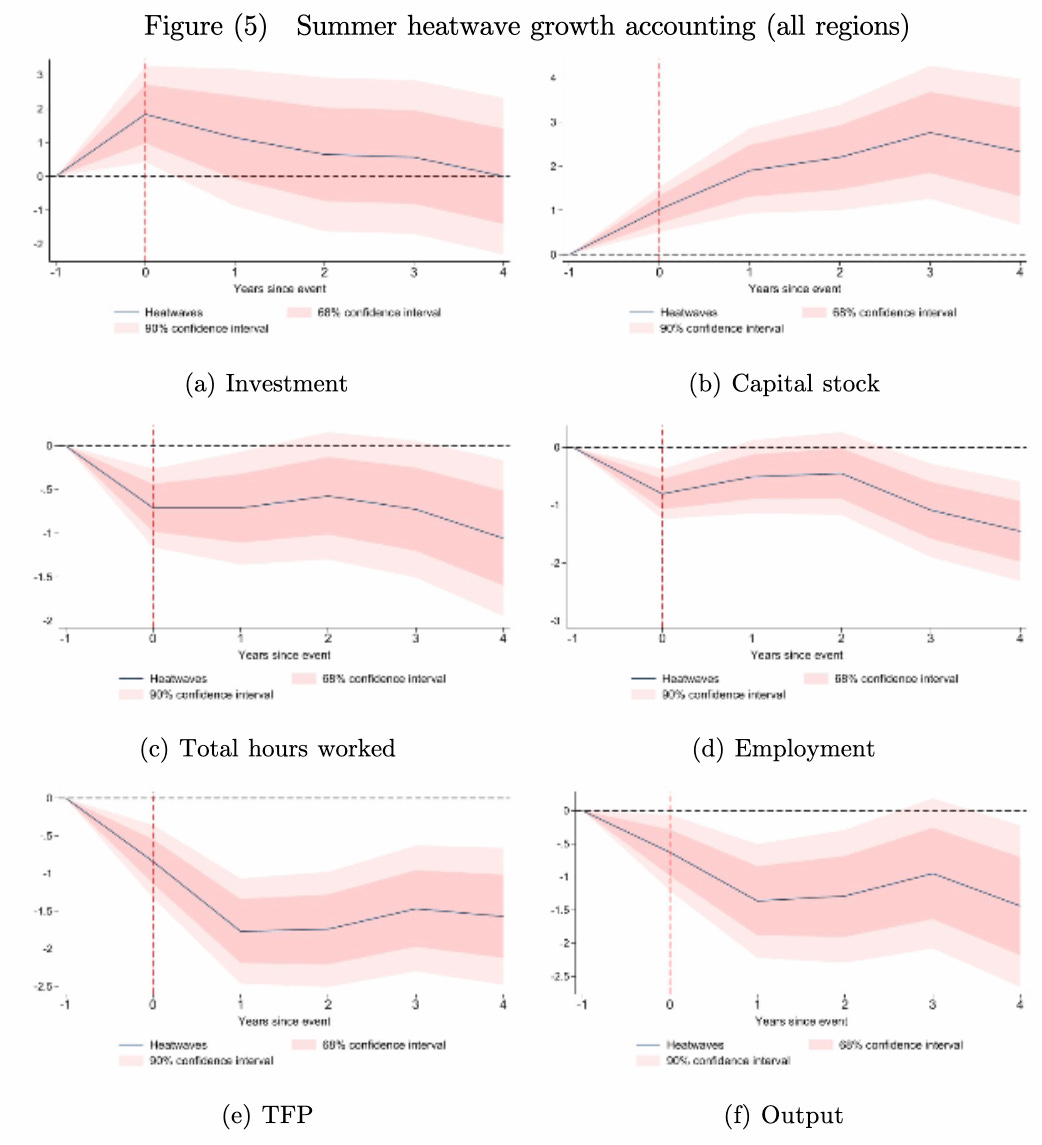

How do we know? The European Central Bank has published the impact of various extreme weather events on local economies. It is extensive: they've categorised 1,160 regions to neutralise the effect of baseline climate (hot regions are better prepared for heatwaves), and the study ran from 1995 to 2022.

The impact on investment, productivity, total factor productivity (TFP) is unquestionable. For companies and governments, anticipating really pays off.

It can get worse in Asia where urbanisation and the diffusion of middle class lifestyles are ongoing. Here is for instance a simulation of how many work hours India would lose in a (bearish) scenario by consultancy McKinsey:

Another angle shows us how beneficial it is for companies and governments: casualties.

Less casualties suggest investments are paying off

There are more extreme weather events, but there haven’t been more casualties. Storms, floods, and droughts kill fewer people today than in past decades, thanks to better forecasts and response:

Storm fatalities have decreased to ~10,000/year globally. Hurricane warnings and evacuations have improved a lot (check what Verisk has to say on that). There are exceptions (e.g. cyclone Nargis in 2008), but they are few and far between.

Floods killed ~5,500 people per year on average (2003–2022), though that too can spike in extreme cases (the 2010 Pakistan floods killed ~2,000, and the 2022 floods ~1,700).

Droughts and consequent famines, which in previous eras killed millions, have also been rarer in the 21st century or better managed (earlier aid responses), although crises still occur (e.g., East Africa). Droughts from 2004–2023 caused far fewer directly recorded deaths annually (~1,100 on average), although indirect famine deaths can be higher and harder to attribute.

Finally, heat waves and extreme temperatures are an emerging killer that often goes undercounted. For example, Europe’s summer 2022 heatwaves are thought to have caused 16,000+ excess deaths, but there are disagreements about that number. EM-DAT (The international disaster database) noted that heat-related mortality is likely underreported historically. As we get better numbers we are seeing that heatwaves can claim thousands of lives.

Our conclusion: if Extreme Weather Events multiply and become more violent, government, corporates and local authorities will need to spend more to keep their effects benign.

So who stands to benefit?

Winners and Losers from the rise of Natural Disasters

1 - Winners

Our NLP/AI engine discovers individually and ranks them by decreasing thematic relevance, but for the sake of clarity we have grouped them in sub-sectors.

For each we’ll give a couple of stock examples but please check the Comps sheet of the investment universe at the end of this paragraph.

A. Personal Protective Equipment (PPE) & Safety Gear

These are specialised protective clothing, helmets, Self-Contained Breathing Apparatus (SCBA), body armour, gloves, boots... in case of fires, chemical spills, active threats, medical emergencies. Stocks include:

MSA Safety [MSA] manufactures SCBAs (for firefighters but not only), gas detection instruments, fall protection, and ballistic helmets.

Lakeland Industries [LAKE]: makes industrial protective clothing, including chemical, flame-resistant (FR), and disposable garments for firefighters (for hazardous materials) and other emergency personnel.

Avon Protection [AVON] manufactures respiratory protection systems (gas masks, SCBAs, powered air-purifying respirators) and ballistic protection (helmets, body armour). Avon supplies law enforcement, the military, and some first responder units.

B. Emergency Communications

We are looking for providers of mission-critical communication infrastructure, such as Land Mobile Radios (LMRs), dispatch systems, command center software, ruggedised mobile devices, and broadband specialised networks like FirstNet in the US. The key is reliability and interoperability rather than bandwidth (your Netflix show will have to wait). The publicly listed companies in this group include:

Motorola Solutions [MSI] a stock we’ve held for ages during our mutual fund management years. MSI is the dominant player in LMR systems (APX radios), command center software (dispatch, records management, video analytics), and body-worn cameras. They are a key supplier of public safety agencies globally and a key partner in FirstNet.

L3Harris Technologies [LHX]: as our readers are aware (since we won’t shut up about it), LHX is a large defense contractor, but it also has a significant public safety communications division providing LMR systems (competing with MSI in some areas).

A bit further afield, long time market favourite cell tower companies like American Tower [AMT] and Crown Castle [CCI] provide critical infrastructure in the US and globally. Stateside, the primary contractor for FirstNet is AT&T [T].

C. Specialised Vehicles & Up-fitting

These are the manufacturers of purpose-built vehicles such as fire trucks (engines, ladders, rescues), ambulances, police cruisers/SUVs, and others. These also include companies that "upfit" standard vehicles with specialised equipment with lights, sirens, communication gear, etc.. Stocks:

REV Group [REVG]: is a leader in specialty vehicles, including fire apparatus (E-ONE, KME, Ferrara brands) and ambulances (Wheeled Coach, Horton, AEV brands). They supply municipalities and other local authorities.

Oshkosh Corporation [OSK]: owns Pierce Manufacturing, a premier brand of fire apparatus. The “Fire & Emergency” segment is a significant part of Oshkosh's business.

D. Emergency Medical Equipment

These are the manufacturers of the medical devices used in pre-hospital emergency care, such as defibrillators, patient monitoring systems, ventilators, ambulance cots/stretchers, and medical supplies. First Responders use them to stabilise and treat patients en route to hospitals. Stocks:

Stryker (SYK): Physio-Control is a major provider of defibrillators (LIFEPAK), automated CPR devices (LUCAS), and ambulance cots/power-load systems. Physio-Control merged with SYK in 2022 and remains as a wholly owned subsidiary that designs and manufactures products distributed through Stryker Emergency Care.

ZOLL Medical (owned by Asahi Kasei. Ticket: 3407 JP, or ASEKY for the ADR). Zoll is a significant competitor to Stryker in defibrillators, patient monitoring, and other EMS equipment.

E. Temporary Power & Equipment Rental

In the immediate aftermath of a disaster, they provide generators, climate control (HVAC), pumps, heavy machinery for debris removal, and other essential equipment. The stocks:

Generac (GNRC) makes standby and portable generators. Major power outage events directly drive both pre-emptive and reactive demand for their products. On conference calls, Generac’s management often comment on power outage trends. Generac’s CEO noted in 2024 that major storms create a significant burst of demand for their products – each big hurricane can add $50 to $100mn in sales as homeowners and businesses rush to buy generators. After a series of hurricanes (Beryl, Helene, Milton) hit the U.S. in 2024, Generac had to hire 400 extra workers to keep up with orders at its factories.

United Rentals (URI): disaster creates a need for aerial work platforms, material handling equipment, generators, pumps, and general construction tools for cleanup and rebuilding. URI’s investor presentations often highlight "disaster recovery" as a demand driver.

Ashtead (AHT.L / ASHTY ADR) operates as Sunbelt Rentals in the US where they compete with URI.

Herc (HRI): Another major equipment rental player in North America, competing with URI and Sunbelt, and seeing similar demand patterns from disaster recovery.

F. Analytics and Data Management

One of the first challenges that follows a disaster is the restoration of law and order. Arms control has been a major topic in the aftermath of Katrina. The companies in this group provide software for computer-aided dispatch (CAD), records management systems (RMS), jail management, evidence management (including body-cam footage), crime analytics, and emergency incident management. They allow first responders to perform efficient dispatching, information sharing, decision making while offline in a difficult context, and compliant record-keeping. Stocks:

Axon (AXON), the leading provider of TASER energy weapons, body-worn cameras, and a growing cloud-based software platform (Evidence.com, Axon Records, Axon Dispatch) for law enforcement.

Motorola Solutions again, as a major player in command center software, including CAD, RMS, and video analytics.

Textron (TXT) offers a range of vehicles including armoured vehicles, unmanned aircraft systems and specialised vehicles for law enforcement and emergency responses.

Tyler Technologies (TYL) provides the police, fire, and EMS agencies with public safety software (CAD, RMS, mobile data).

Verisk Analytics (VRSK)’s expertise extends beyond law and order. Verisk has built extensive data sets to provide risk assessment and predictive analytics for insurance coverage, fire protection, catastrophe and weather risk.

G. Specialised & industrial cleaning; environmental services

These companies handle more complex cleanup scenarios, often involving hazardous materials, industrial facility damage, or large-scale environmental remediation. They are needed in case of oil/chemical spill response (for example if a chemical plant gets flooded), hazardous waste removal, or the decontamination of critical infrastructure. Stocks:

Clean Harbors [CLH] operate in hazardous waste management and emergency response, for large-scale cleanups after industrial incidents or widespread contamination (e.g., post-hurricane spills, wildfire ash and debris). Their "Safety-Kleen" service can manage total clear-outs, surveys and other industrial collection services. Management often discusses the positive impact of hurricane seasons on their emergency response revenues.

Waste Management [WM] and Republic Services [RSG]. These two are primarily waste haulers, but they offer their large-scale debris removal capabilities after disasters, when they have to handle immense volumes of storm debris, construction & demolition waste from damaged structures. They can offer emergency contracts to the affected municipalities.

H. Property Restoration & Remediation Services

These companies specialise in cleaning, repairing, and restoring properties (residential, commercial, industrial) that have been damaged by water, fire, smoke, and storms. That means water extraction, dehumidification, structural drying, soot and smoke removal, contents cleaning, and often some general contracting for reconstruction. Insurance payouts typically fund a large portion of this work. Stocks include:

APi Group [APG] has significant exposure to repair and restoration, particularly in fire safety and building services. They have been involved in immediate post-event system checks/repairs and larger rebuilds.

FirstService Corporation [FSV] owns Paul Davis Restoration, a franchise network specialising in property damage emergency services, restoration, and reconstruction. Their earnings calls often explicitly mention the impact of catastrophe events (hurricanes, floods, wildfires) on Paul Davis's performance.

I. HVAC and Cooling Suppliers

Heatwaves and record high temperatures create demand for HVAC (Heating, Ventilation, and Air Conditioning). The Summer 2023 has boosted the industry as heatwaves were spread across the US, Southern Europe, and China that year. Stocks that could be of interest:

Carrier Global (CARR) is a leading HVAC manufacturer based in the US. They provide heating, ventilation, and air conditioning (HVAC), refrigeration, and fire and security equipment.

Trane Technologies (TT) and Lennox International (LII) also benefit from a spike in orders for both residential and commercial cooling systems during hot summers. Favourable policies (energy efficiency rebates, bans on older refrigerants) can boost sales of newer, more efficient AC units and allow companies to sell higher-margin, efficient models.

European HVAC suppliers (like Daikin Europe [6367 JT], or Siemens’ “Building Technologies” division) also saw robust demand as customers sought relief from extreme heat. Air conditioning historically had lower penetration in Europe, but adoption is now climbing rapidly.

J. Building Materials & Home Improvement Retail

Here is the link between the stocks and our theme is starting to look tenuous. On one hand, these companies do more business following extreme weather events, but on the other, Natural Disasters are not (yet) seen by investors as critical to the investment case. You don’t buy Home Depot in anticipation of a strong hurricane season. Still we look for ideas in:

Manufacturers of building materials (cement, roofing shingles, pipes) who get a volume boost from reconstruction. For instance, asphalt shingle makers (like Owens Corning, who also produces insulation, roofing, and fiberglass composites) often see higher orders after hailstorms and hurricanes destroy roofs.

Engineering and construction firms also benefit: companies involved in infrastructure repair (roads, bridges, levees) see increased government contracts post-disaster. An example in Europe is Vinci [DG] and Eiffage [FGR], two French construction groups, who won contracts to rebuild flood-damaged roads and rail in 2021–2022.

Heavy equipment suppliers (Caterpillar [CAT]) may also sell more machinery for cleanup and rebuilding efforts.

And, as mentioned, Home Depot [HD], who reported a notable sales uptick tied to hurricane recovery in 2024. In its Q3 2024 results, Home Depot saw about a $200mn boost in sales from hurricane-related demand, as residents in the southeastern U.S. bought generators, plywood, batteries, and other rebuilding supplies. The CEO highlighted “incremental sales related to hurricane demand” driving unexpectedly positive comparable sales in October of that year. The same demand benefits home improvement peer Lowe’s [LOW].

K. Miscellaneous

Some potential beneficiaries can be part of larger industries perceived to be negatively affected. Three examples come to mind:

The big agribusiness trading houses (Archer Daniels Midland [ADM], Bunge [BG]) benefit from price volatility, as higher prices can boost trading profits. But if a disaster is widespread, the lack of volume can hurt processing margins.

Fertiliser and seed companies (Bayer/Monsanto [BAYN], Corteva [CTVA]) could benefit from an increase in demand for climate-resilient products: seed producers offering drought-tolerant crops or pest-resistant strains. This is a slow, gradual market disruption, but one a lot of companies claim to factor in their strategic planning.

Insurance brokers (Aon [AON], Marsh McLennan [MMC]) can benefit as they don’t bear underwriting risk and earn higher commissions as premiums rise.

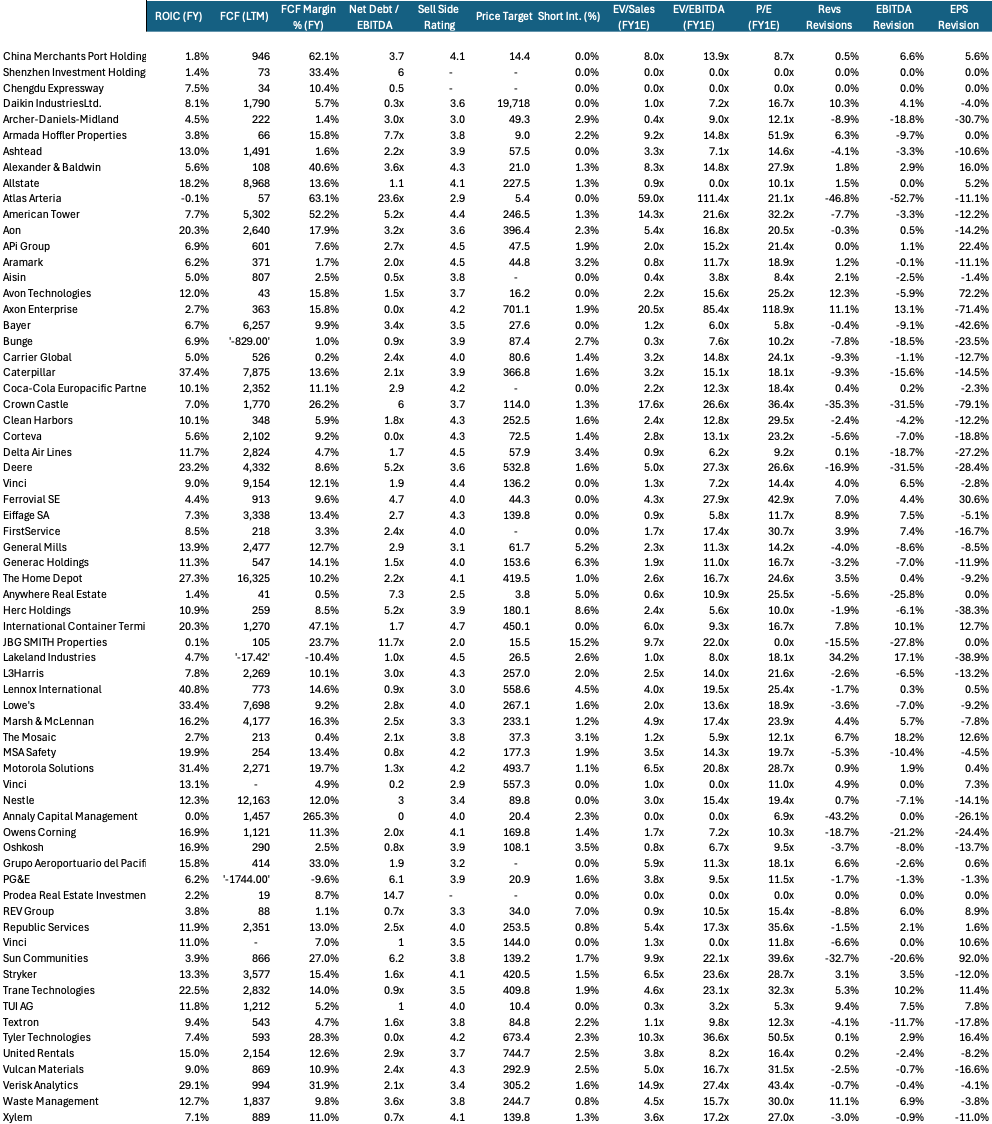

Here are the key financial metrics of these companies as well as the “Losers” listed below (source: Koyfin)

2 - Losers

First and foremost: our “losers” aren’t all outright shorts just because they suffer from extreme weather events.

Many of them are companies whose business can be hit by such events but, apart from a few exceptions, it won’t disappear because of it. This isn’t Blackberry before the iPhone. However, if the business is weak at its core (low returns, high leverage, no moat), a natural disaster can tip them over.

In that case, pairing them (or baskets of them) with Theme winners makes a lot of sense.

A. Utilities & Energy Infrastructure

Utilities with physical grids are vulnerable to extreme weather damaging infrastructure and triggering liabilities. In the US PG&E, for instance, incurred massive liabilities from wildfires in California, forcing it to invest heavily in grid hardening and safety shut-offs.

Storms, windstorms and hurricanes knock down power lines: in 2024 the US saw 1.2 billion hours of power outages in the first nine months, the worst on record, largely due to severe weather stress on the grid. Some of these costs are recovered through insurance or rate hikes, but there can be a lag, affecting near-term profits. Billions are now spent on resilience (under grounding lines, enhanced maintenance), which can dent earnings growth.

Power generation strains: extreme weather can also disrupt generation output. Heatwaves in particular are a double-edged sword – they spike electricity demand for cooling, but can reduce output for certain producers. France’s EDF had to curtail output at multiple nuclear plants in 2023 because river water was too warm to safely cool reactors. Output at two major plants was cut by roughly half during a heatwave, an unusual early-summer constraint that underscores climate stress on power infrastructure.

Hydroelectric generators face a similar issue: droughts and heat can deplete reservoirs (as seen in Southern Europe’s 2022–2023 drought). These factors can hurt utility revenues and spark higher power prices.

One caveat: this can be a positive for utilities with flexible generation or excess capacity who can profit from price spikes during heatwaves or cold snaps. For example, Southern European utilities saw record power demand during 2023 heatwaves, which allowed them to sell more power at high spot prices.

In the main, however, weather volatility introduces uncertainty into utilities’ volume forecasts and O&M costs. Risk and volatility is not what most investors look for in a utility stock.

B. Property & Casualty Insurers

Insurers absorb billions in catastrophe claims. These losses directly hit quarterly earnings and lead to lower near-term profit guidance for many insurers. In Europe, 2024 marked the 5th consecutive year with more than $100Bn in insured catastrophe losses, prompting higher premiums and stricter underwriting.

There’s an important offset for insurers: premium hikes & market retreats. Insurers have been aggressively raising premiums and reevaluating coverage in high-risk regions. In California, both State Farm and Allstate [ALL] stopped selling new homeowner policies due to wildfire risks and soaring costs, with Allstate filing for a 40% rate increase to offset higher claims.

Insurers with strong pricing power or global diversification could outperform peers by offsetting losses with premium increases - but they are the proverbial “best house in a bad neighbourhood”. So which stocks?

Reinsurers (like Swiss Re and Munich Re [MUV2]) have also paid out heavy claims. Swiss Re estimates $137Bn in insured disaster losses for 2024, rising to $145Bn in 2025, and acknowledges climate change is “compounding losses” for certain perils. The near-term result is a “hard” insurance market: higher premiums benefit insurers’ top line but could pressure affordability and volumes.

Allstate’s [ALL] catastrophe losses in Q2 2023 more than doubled to $2.7Bn (from $1.1Bn a year prior) amid dozens of severe weather events.

C. Agriculture & Consumer Staples

Droughts, floods, and heatwaves reduce crop yields, driving up commodity prices and squeezing food supply chains. In Europe, for instance, a two-year drought and record heatwave cut Spain’s olive oil output by about 50%, contributing to a doubling of olive oil prices by late 2023. In North America the 2023 summer heat dome harmed crops like cotton and corn, and Canadian prairie droughts reduced wheat yields, also pressuring global grain prices.

This directly impacts consumer staples companies: higher input costs for food manufacturers (e.g. a packaged foods company paying more for olive oil, grains, or sugar), which can compress margins until price hikes are passed through.

Extreme weather can also disrupt supply chains (floods blocking transport routes or hurricanes damaging storage facilities), causing short-term logistical costs for agricultural commodity traders and processors.

So which stocks are affected?

Companies like General Mills [GIS] and Nestlé [NESN] have noted rising raw material costs linked to unusual weather, and brewers/distillers have warned of poor harvests for barley, grapes, etc., affecting production volumes.

Farm equipment makers (like Deere [DE]) might see regional dips in sales if farmers’ incomes are hurt by crop loss, though insurance payouts and government disaster aid often offset this, sometimes even spurring equipment replacement demand (e.g. replacing flooded tractors).

Companies dependent on water (from soda bottlers to semiconductor fabs) are increasingly flagging water risk in their filings. While not always an immediate earnings hit, back-to-back hot summers could force cutbacks (some breweries in Europe had to adjust production schedules due to water shortages). Beverage makers like Coca-Cola EuroPacific Partners [CCEP] have invested in water efficiency and source diversification, anticipating more volatile supply. These preventive moves are strategic shifts to ensure business continuity amid climate swings.

D. Infrastructure Assets and REITs

Real estate in coastal or high-risk areas: a catastrophic event can lead to property damage, temporary loss of rental income, and higher insurance costs upon renewal. Higher insurance premiums are a major headwind for property owners – in disaster-prone regions like Florida or California, commercial property insurance costs have spiked, eating into net operating income for REITs and forcing some to self-insure more. Insurance typically covers some rebuild costs, but not all the revenue lost. The “Risk Factor” section of 10k/Q are a good way of finding which stocks is at risk. Here are a few examples:

Alexander & Baldwin [ALEX]: who operates exclusively in Hawaii, has assets “vulnerable to natural disasters, such as hurricanes, earthquakes, tsunamis, floods, sea level rise, wildfires, tornadoes”. In addition, natural disasters could damage other real estate holdings like dams and reservoirs reported in the “Land Operations” segment.

Anywhere Real Estate [HOUS] (owner of Corcoran, Sotheby’s Realty, Coldwell Banker). Anywhere’s “Owned Brokerage Group” business has a significant concentration of offices and transactions in coastal regions like California and Florida.

Annaly Capital Management [NLY]: an investor in agency mortgage-backed securities (“MBS”) collateralised by residential mortgages, is exposed to assets in coastal states susceptible to hurricanes and sea-level rise, with potential impacts on real estate values.

Armada Hoffler Properties [AHH]: properties in Virginia Beach, Baltimore, and Mid-Atlantic regions, exposed to hurricanes and flooding.

But also: Prodea Real Estate Investment [PRODEA.GR], JBG SMITH Properties [JBGS], Sun Communities [SUI] (properties and marinas on coastlines and in areas prone to hurricanes, flash floods, and sea-level rise)…

Infrastructure Assets: listed infrastructure (ports, toll roads, airports) can also be affected. A major storm can shut down an airport for days (loss of traffic and revenue) or damage a port’s facilities. For instance, Hurricane Harvey in 2017 closed Houston’s port temporarily.

Low level in rivers to the point that they become unnavigable (either from drought or floods) can impact transport companies because there’s a link missing on the route that has to be replaced (higher costs, longer travel time). Many of these firms are now investing in protective measures: sea walls, improved drainage, backup power systems… which inflates Capex and reduces free cash flow. The stocks at risk include:

Ports: like China Merchants Port [144 HK] or International Container Terminal Services [ICT PH] are affected by thunderstorms and typhoons.

Toll Roads: Atlas Arteria [ALX.AU] and Ferrovial [FER] operate in the US and Canada, where heatwaves and cold snaps have reduced traffic, while Chengdu Expressway [1785 HK] and Shenzhen Investment Holdings Bay Area Development [737 HK] can have heavy rainfall affect highways operations.

Airports: Grupo Aeroportuario del Pacifico [PAC] claim in their 20-F that “The Pacific and Central regions of Mexico and the island of Jamaica experience seasonal torrential rains and hurricanes, particularly between July and September, along with earthquakes. These extreme weather events can disrupt operations”.

E. Tourism

Airlines and Hotels: Airlines have reported a growing number of flight delays and cancellations due to storms, hurricanes, and even wildfire smoke. Climate-related weather delays as a share of total flight delays nearly tripled over the past decade, from ~11% in 2012 to almost 30% in 2023). These incidents raise costs (crew reassignments, customer rebooking, etc.) and shave a few percentage points off quarterly revenue growth or drive one-time expenses. For example:

In the Summer of 2023, North American airlines had to cancel or reroute flights due to unprecedented wildfire smoke blanketing cities, and several major storms led to hundreds of flight cancellations.

On the resort side, the Maui wildfires in 2023 forced resort closures in West Maui (impacting hospitality companies with assets in Hawaii), and a hurricane hitting Florida’s tourism corridor can temporarily hurt theme park attendance and hotel occupancy.

TUI, one of the world’s largest tour operators, had to evacuate 8,000 customers from the Greek island of Rhodes because of wildfires, and cancel many holiday packages. The company estimated the wildfires would cost ~€25mn in one-time charges (refunds, compensation, evacuation flights), a direct hit to full-year earnings. TUI’s CEO noted that extreme weather is now a factor in their outlook, and the firm is even considering new insurance products for climate-related disruptions to dampen future impacts.